Welcome to Hashpower Academy, where we simplify Bitcoin’s backbone. In “A NEW Way to Understand Mining Pools,” we break down how pools fit into the BTC network.

What’s Covered:

Mining pools 101: Groups of miners sharing hashrate and rewards.

Network role: Pools bridge solo miners to Bitcoin’s blockchain.

Why they matter: Steady payouts vs. solo’s rare wins.

How they work: Pool operators sync hardware, split BTC.

Big picture: Pools keep Bitcoin humming—hashrate hubs.

Key Insights:

Network glue: Miners + pools = blocks every 10 minutes.

Reward split: Fair cuts based on your hashrate share.

Not solo: Pools tame the 1-in-millions block odds.

Why Watch:

See mining pools as Bitcoin’s teamwork engine.

Grasp their place in the BTC ecosystem—fresh and clear.

Join Hashpower Academy to rethink mining pools—watch now and connect the network dots!

Financial Disclaimer:

This video serves educational and informational purposes only and should not be construed as financial advice or investment recommendation. The views expressed are those of the presenter and do not represent Hashpower Academy’s official stance. Information is provided ‘as is’ without warranties, express or implied, as to its accuracy or completeness. Engaging with Bitcoin involves high risk, including potential financial loss, market volatility, and energy costs, and is suitable only for those who can bear these risks. Always conduct your own research and consult with a qualified financial or technical advisor before making decisions related to Bitcoin.

#Bitcoin

#MiningPools

#BitcoinMining

#Crypto

#BTC

#PoolMining

#F2Pool

#AntPool

#SlushPool

#ViaBTC

#Bitmain

#Whatsminer

#MicroBT

#Canaan

#MiningHardware

#Blockchain

#CryptoMining

#BitcoinNetwork

#Hashrate

#BTCmining

Video Transcript:

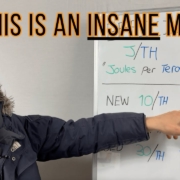

hello there and welcome to the hash power Academy my name is Jake and this is where we talk about anything and everything to do with Bitcoin and its wider underlying Network in the topic of today’s video we’re going to look at what a mining pools and what do they do but first let’s just run through the layers of the Bitcoin Network in a six-part format that is to say that we produce electricity transfer over time produce compute power transfer it over time produce Bitcoin and store it over time and basically that boils down to Energy Technologies such as solar and energy commodity electricity compute Technologies as6 CPUs gpus the timeline compute commodity they all produce hash rate Bitcoin blocks continually being added to the chain increasing the full supply of 21 million units distributed over well issued shall I say over the next 100 plus years until we reach that full 21 million cap and the context of today’s video what are mining pools well mining pools sit at the heart in the middle of the Bitcoin Network in the sense that compute power is the interplay between energy and finance for this network as you can see and that is to say that energy producers are producing power and Bitcoin miners are consuming it Bitcoin mining produces compute power and the production of compute power like electricity sort of has to be used then and there because there’s well the the context of battery storage for compute power is essentially Bitcoin and Bitcoin is essentially the digital equivalent of a battery in weird sense but you get the gist Bitcoin blocks require the consumption the reusable aspect of proof of work and there’s another there’s another one actually up here and rejoins there but we’ll discuss that another day but overall the production of Bitcoin and maybe the consumption of it in exchange for electricity but the gist here is where do mining pools fit in mining pools fit here they are the producers of Bitcoin blocks and where do they source that ability to produce Bitcoin blocks by exchanging with Bitcoin miners to buy their hash rate and I say buy their hash rate because a lot of miners are using fpps which means full pay per share and that essentially means that they are just getting paid for their hash rate and so the majority of miners are not even producing their own blocks they are selling their commodity of hash rate to the mining pools and the mining pools produce the blocks and sell them sell some of that distribution but in a quantity of Bitcoin per terahash of compute over time that is Hash price that’s one of the standard metric for comparing different blockchains at the blockchain level as to the amount of bit coin per compute power per time so the amount of digital energy you can produce with your uh conversion into hash rate from your consumption of electricity and so mining pools sitting at that bridge between these two worlds make them critically important they are the issuance mechanism of Bitcoin coming into circulation because the majority of blocks are produced by Bitcoin mining pools that’s not to say all of the blocks are produced by Bitcoin mining pools some of them are produced by solo miners or just a large scale Miner that they represent their share of hash rate in in the in the blocks that they produce and the interesting aspect of every layer of the Bitcoin network is what I like to call willing participants you can produce your own power or buy it from an electrical grid you could produce your own mining Hardware or buy it from a manufacturer and run it yourself you could produce your own Bitcoin blocks or use a mining pool you could store your own Bitcoin or store it in a platform so there’s this optionality uh between in everything to do with Bitcoin but producing your own energy and producing your own Hardware right now have extreme economies of scale especially the compu microchip side of things versus producing your own energy this could be as small as a solar panel a single machine maybe some batteries uh connected to the internet mining to a pole and earning Bitcoin there’s interoperability with all the different pieces of the network but I’ll leave it there for now in terms of mining pulls but the other aspects of mining pools on the business side is the upside capture of um your Bitcoin by selling hash rate or buying hash rate in forward contracts and as mining pools have liquidity in compute context they have the ability to maybe sell some of that compute if they’ve already paid the miner in real time there’s also that access to liquidity because miners have an input of electrical bills so that access to some form of Bitcoin Financial options means that interplay between energy and finance has a business perspective and this is what we’re going to see from mining pools going forwards that every different business within this network is expanding in their own directions and while the majority of the finance world are obsessed with Bitcoin as collateral and the energy sector obsessed with Bitcoin as a yield the sector in the middle of compute the embodiment of compute consumption versus Hardware manufacturers which could be the embodiment of compute production all of these different business are going in their own Direction because it truly is quite difficult to draw this in a linear fashion or not in a three-dimensional fashion still doesn’t doesn’t complexify as as as to how how much interplay there is between all of these different businesses but I think that’ll be that’s where we’ll leave it for now I hope you enjoyed this video if you want more more of these sorts of videos I will I’m going to do all of the six different Core Business areas shall I say of energy producers utilities Hardware manufacturers and miners mining pools the Bitcoin blockchain which could be considered different layers and platforms that use Bitcoin as money in the context of Finance as collateral uh ETFs which are just IOU tokens of Bitcoin what they do with the Bitcoin underneath who knows thank you for listening I hope you enjoyed like subscribe and I’ll see you in the next one goodbye

Social Media