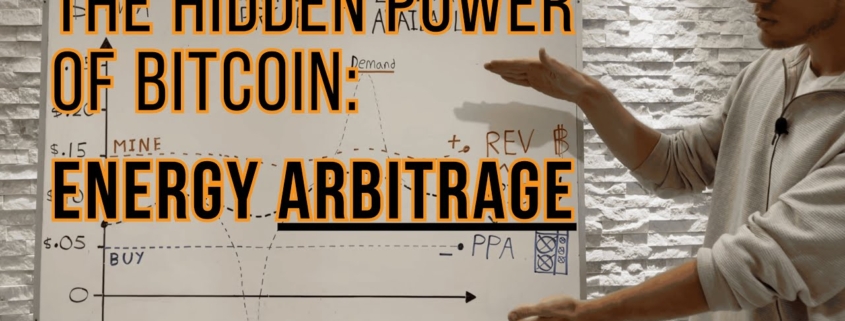

Bitcoin Mining’s Hidden Power: Energy Arbitrage! #BTCkWh | Hashpower Academy

Unlock the hidden superpower of Bitcoin mining in this timeless gem! I break down how miners’ computers stabilize energy grids while stacking BTC. Here’s the secret: miners snag power cheap (low $/kWh), turn it into Bitcoin at a profit, then sell excess power back when prices spike (high grid demand). When power’s abundant and cheap, they soak it up—hyperscaling the network! This arbitrage keeps grids rock-solid, boosts energy abundance, and benefits us all. Perfect for beginners or pros—watch to see why miners are the grid’s unsung heroes!

🎓 Hashpower Academy Donations (Thank You!):

🟧 L1 Bitcoin: bc1qlgkc4pyrz22cykrx49cmuku3zyy2nuequu6r9y

⚡ L2 Lightning: academy@walletofsatoshi.com

Free Bitcoin Course! (Big Picture Basics):

https://www.hashpower.academy

I got my Bitcoin Mini-Miner from IXTech (10% off with code JAKE):

https://ixtech.xyz/?ref=JAKE

Align a meeting if you are looking to discuss Mining/Hosting and other Business Inquiries:

https://calendly.com/terahash/30min

Financial Disclaimer:

This video serves educational and informational purposes only and should not be construed as financial advice or investment recommendation. The views expressed are those of the presenter and do not represent Hashpower Academy’s official stance. Information is provided ‘as is’ without warranties, express or implied, as to its accuracy or completeness. Engaging with Bitcoin involves high risk, including potential financial loss, market volatility, and energy costs, and is suitable only for those who can bear these risks. Always conduct your own research and consult with a qualified financial or technical advisor before making decisions related to Bitcoin.

#Bitcoin

#BitcoinMining

#Crypto

#Energy

#GridStability

#MiningPower

#BTC

#CryptoMining

#EnergyGrids

#BitcoinEducation

#MiningBasics

#EnergyAbundance

#BitcoinNetwork

#Arbitrage

#CryptoEnergy

#LearnBitcoin

#BitcoinStability

#MiningSecrets

#EnergyMarkets

#Hashpower

Video Transcript:

hello there and welcome My name is Jake Scandlin and I’d like to take you through what I call the electron liquidity of the Bitcoin network or even more simply the energy exchange rate of Bitcoin Now the first piece to understand here is that the energy price on the grids is based on what’s available supply and demand We produce a certain amount of power and we all consume a certain amount of power And the 21st century completely depends on the electricity grid And so we want to keep it stable the supply and demand And that’s also reflected in price That the optimal condition of the electricity grid is that the price is reflective of stability If we have an upside of too much demand of power and a downside of too much supply of power both reflected in price These conditions create instability that could shut the grid off and that causes even more damage and problems of the world Think about all the hospitals with ICU beds that they need to stay online That’s an extremely important use of electricity But Bitcoin’s context of energy usage is an economic one Bitcoin miners will purchase electricity at an effectively lower rate because they’re buying in very large quantity and they are producing certain amount of Bitcoin with that electricity purchase But here’s the thing as I said there are an economic incentive to using electricity If the electricity price was to rise higher let’s say 25 cent a kilowatt but if they consumed it they’d only make 15 cents Why would they use the power they would switch the machines off and sell power into that demand to bring the price down Inversely the renewable energy future is creating environments where electricity goes negative not this nonsense about Bitcoin using too much energy The electricity grid sometimes has too much energy and someone needs to buy all of that excess supply to bring the price back to stability bringing the grid back to stability So Bitcoin miners will dynamically buy energy that’s cheap and will sell energy that’s expensive to bring the price of electricity back within reason And that’s why Bitcoin mining I consider to have an electron exchange rate and an energy liquidity is because they will dynamically buy power and sell power which stabilizes the grid from the upside and the downside That’s a very interesting thing because as I said we have a renewable future which is intermittent The problem with renewables is that nature is now in control of when we produce power And the grid remains stable if supply and demand are balanced But if we only get power when the sun’s shining the wind’s blowing and the water’s flowing through our hydro dams well that means we have to dynamically change how much power we use in our homes No that’s not how people live But if there is an energy customer out there that will dynamically change how much power they are buying or selling to bring the price of electricity back into stability Well that’s the perfect customer Dynamic energy supply needs dynamic energy demand An economic incentive user of electricity I hope that’s interesting Let me know your thoughts

Leave a Reply

Want to join the discussion?Feel free to contribute!